Bellman-Ford Algorithm: From Shortest Paths to Currency Arbitrage

Discovering Bellman-Ford’s Hidden Power

Today I stumbled upon a fascinating application of the Bellman-Ford algorithm that goes beyond traditional shortest path problems. While the algorithm is well-known for finding the shortest paths from a source to all other nodes in a graph (even with negative edge weights), its ability to detect negative cycles opens up intriguing possibilities in finance, particularly in currency arbitrage.

The Basics: Shortest Paths and Negative Cycles

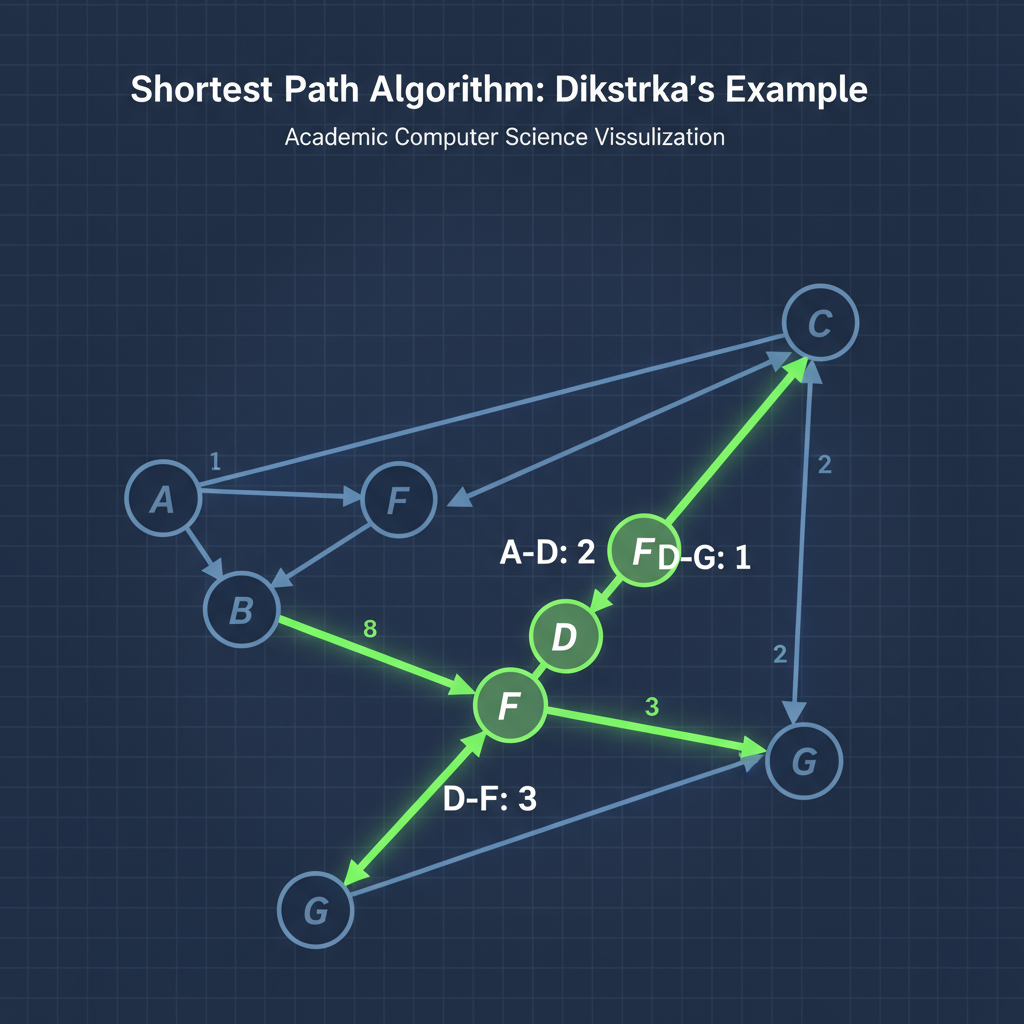

At its core, Bellman-Ford is a dynamic programming approach that relaxes edges repeatedly to find optimal paths. It initializes the distance to the source as 0 and all other nodes as infinity, then iteratively updates distances by considering each edge. After V-1 iterations (where V is the number of vertices), it can detect if any further relaxation occurs—if it does, a negative cycle exists.

This negative cycle detection is key. In graph terms, a negative cycle means you can keep traversing it to reduce the total path cost indefinitely. In arbitrage contexts, this translates to infinite profit opportunities.

Applying Bellman-Ford to Currency Exchange

The connection to arbitrage is elegant. In currency markets, we deal with exchange rates between currencies, and arbitrage seeks to exploit rate differences by finding a cycle where the product of exchange rates exceeds 1 (meaning you end up with more money after converting back to the starting currency).

To apply Bellman-Ford, we model currencies as nodes and exchange rates as edge weights. But here’s the clever part: instead of using the raw exchange rates, we take the negative logarithm of each rate. This transforms multiplication into addition, turning the maximum product problem into a minimum sum problem—exactly what Bellman-Ford solves.

Mathematically, if we have exchange rates r_ij (rate from currency i to j), we set the edge weight from i to j as -log(r_ij). Now:

- Finding a cycle with negative total weight means the product of the original rates > 1 (arbitrage opportunity)

- The algorithm can also find the best exchange path between any two currencies

Real-World Example: Multi-Currency Arbitrage

Imagine you want to convert USD to NZD. Direct exchange might not be optimal. By using intermediate currencies like JPY, you might find a cheaper path: USD → JPY → NZD instead of USD → NZD directly. Bellman-Ford can identify these efficient routes by finding the shortest path in the transformed graph.

If a negative cycle is detected, it means there’s a loop where you can multiply your money indefinitely (in theory). In practice, you’d follow the cycle until transaction costs or market adjustments make it unprofitable.

Why This Matters

This application beautifully bridges pure algorithm design with real-world finance. Bellman-Ford’s efficiency (O(V*E) time complexity) makes it practical for computing arbitrage opportunities across multiple currency pairs, especially when combined with real-time market data.

It’s a reminder that classic algorithms often have surprising applications beyond their original intent. The mathematical transformation from multiplicative gains to additive costs is particularly insightful, showing how logarithms can simplify complex optimization problems.

Reflections

Exploring this connection has reignited my appreciation for graph algorithms. It’s exciting to see how a tool designed for pathfinding can uncover profit opportunities in global markets. I plan to experiment with implementing this in code, perhaps building a simple arbitrage detector using exchange rate APIs.

This also highlights the importance of interdisciplinary thinking—combining computer science fundamentals with domain-specific knowledge can lead to powerful insights.

Note: This post draws from recent thoughts on applying classic algorithms to modern financial problems. The arbitrage example is conceptual; real-world trading involves many additional factors like fees and market liquidity.